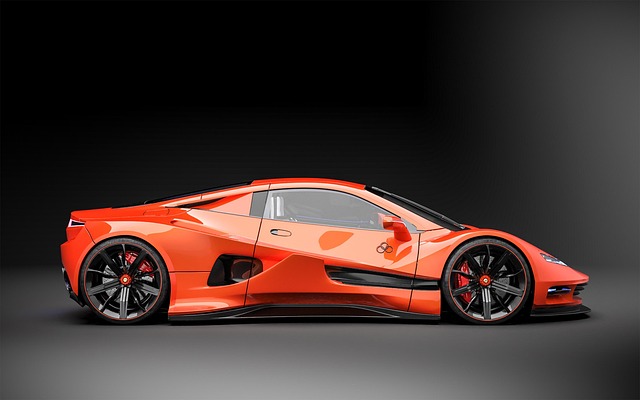

The auto industry's health significantly influences car title loan default statistics. During economic prosperity, high vehicle sales boost potential borrowers, but downturns elevate default rates as financial strain increases. Manufacturers' incentives, market trends, and consumer behavior intricately tie into default trends, with promotions potentially attracting less stable individuals and technological advancements leading to higher debt levels. Auto sector performance shapes risk profiles, while changes in sales and regulations affect loan approval decisions and repayment patterns, directly impacting default rates.

The auto industry’s health directly impacts car title loan default trends, making it crucial to understand their interconnectedness. This article delves into how economic fluctuations within the sector influence borrower behavior and default rates on these loans. We explore manufacturing trends, sales volumes, and consumer confidence as key factors shaping default statistics.

Through a lens of demographic analysis, vehicle characteristics, and economic indicators, we uncover risk factors associated with car title loans. Furthermore, we present strategies for lenders and borrowers to mitigate defaults, including improved credit assessment, borrower education, and responsible borrowing practices.

- The Auto Industry's Role in Shaping Car Title Loan Default Trends

- – Exploring the connection between economic health of the auto sector and default rates on car title loans

- – Impact of manufacturing fluctuations, sales volumes, and consumer confidence

The Auto Industry's Role in Shaping Car Title Loan Default Trends

The auto industry plays a significant role in shaping car title loan default statistics. As one of the largest and most dynamic sectors in the global economy, fluctuations in vehicle sales, production, and consumer confidence directly impact the demand for secured loans, such as title pawns. When the economy booms, consumers are more likely to purchase new vehicles, increasing the pool of potential borrowers seeking emergency funding through these short-term loans. Conversely, during economic downturns or recessions, a decline in auto sales can lead to higher default rates on car title loans, as individuals face financial strain and may struggle to meet their loan obligations.

The relationship between the auto industry and title loan default trends is intricate. Manufacturers’ incentives, market conditions, and consumer behavior all contribute to variations in default statistics. For instance, promotions or rebates offered by automakers can boost sales but may also encourage less financially stable individuals to take out loans for new vehicles, potentially increasing the likelihood of defaults. Furthermore, changes in vehicle technology and affordability can influence consumer choices, with advancements making cars more accessible but also potentially leading to higher debt levels among borrowers seeking title pawn services to fund these purchases.

– Exploring the connection between economic health of the auto sector and default rates on car title loans

The health of the auto industry has a profound impact on car title loan default statistics. When the economy booms and consumer confidence is high, individuals are more likely to purchase vehicles, leading to increased demand for financing options like car title loans. Conversely, economic downturns can result in higher default rates as borrowers face financial strain, making it challenging to meet repayment obligations. Auto sector performance influences not only the overall lending landscape but also the risk profile of borrowers seeking short-term funding.

Additionally, changes in vehicle sales and market trends directly correlate with loan approval decisions and default risks. As new models are released and technology advances, consumer preferences shift, impacting the demand for certain types of vehicles and, by extension, the availability and terms of car title loans. Moreover, factors such as fuel efficiency standards and environmental regulations can influence both auto industry dynamics and borrower behavior, ultimately affecting loan repayment patterns and default rates.

– Impact of manufacturing fluctuations, sales volumes, and consumer confidence

The auto industry’s performance significantly influences car title loan default statistics. Manufacturing fluctuations can dramatically affect sales volumes, leading to market volatility. When economic conditions wane, production may decline, and consumers tend to hold off on major purchases, including cars and associated financing. This shift in purchasing behavior can result in higher default rates for secured loans like car title loans, as borrowers face financial constraints or lose their jobs. Consumer confidence plays a crucial role too; during times of economic uncertainty, individuals with bad credit may find it harder to secure traditional loans, pushing them towards alternative options like these secured loans, which could further exacerbate default statistics.

Sales volume trends also have a direct impact. A bustling auto market with high sales volumes typically leads to more active loan activities, including car title loans. However, if the market takes a turn for the worse, with declining sales and an increase in vehicle inventory, it may indicate struggling consumer confidence and potential default risks. Keeping your vehicle as collateral in these secured loans can provide some security for lenders, but borrowers must remain committed to repayments, or they risk losing their titles.

The auto industry’s cyclical nature significantly influences car title loan default statistics. Manufacturing fluctuations, sales volume peaks and troughs, and shifts in consumer confidence directly correlate with changes in default rates. As economic health wavers within the sector, so too do the financial obligations of borrowers, leading to increased risk for lenders. Understanding these connections is vital for navigating the volatile landscape of car title loan defaults and developing strategies to mitigate risks associated with this lending sector.