Economic factors like unemployment and inflation significantly drive car title loan default statistics. Loan terms, including approval speed, interest rates, and repayment periods, play a critical role in borrower behavior. The condition of a borrower's vehicle influences their likelihood to default, with well-maintained cars linked to lower default rates. Promoting responsible ownership and vehicle maintenance could improve car title loan default trends.

“Unraveling the intricate relationship between the auto industry and car title loan default statistics is a vital step in understanding financial risks. This article explores critical factors shaping default rates, including economic trends and their influence on borrowers’ repayment abilities. We delve into the intricacies of loan terms, conditions, and their effect on default predisposition. Additionally, the impact of vehicle condition on borrower behavior is analyzed, providing a comprehensive view of car title loan dynamics.”

- Economic Factors Influencing Default Rates

- Loan Terms and Conditions Analysis

- Impact of Car Condition on Repayment Behavior

Economic Factors Influencing Default Rates

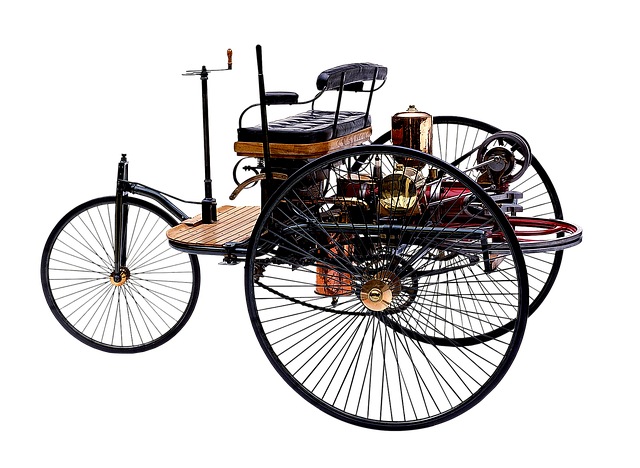

Economic factors play a significant role in shaping car title loan default statistics. Unstable economic conditions, such as high unemployment rates and inflation, can lead to increased default risks among borrowers. When individuals face financial strain, they may struggle to meet their loan obligations, especially for secured loans like car title loans, where the vehicle serves as collateral. During recessions or periods of economic downturn, default rates tend to rise as borrowers grapple with reduced income and higher living expenses.

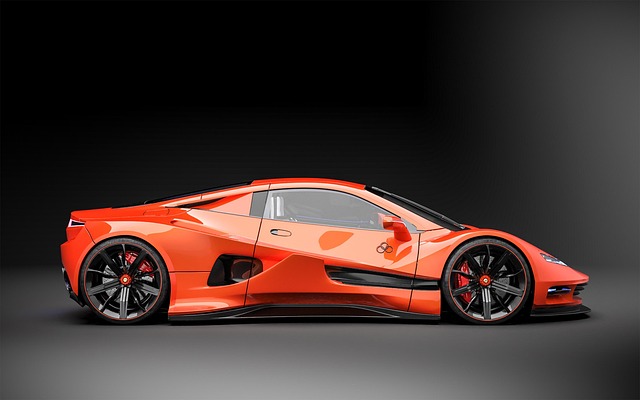

Additionally, factors related to vehicle ownership and market dynamics influence default statistics. The value of a vehicle can fluctuate based on various economic indicators, which affects the overall worth of the security for these loans. As market conditions change, borrowers may find themselves in a position where keeping their vehicle becomes challenging, prompting them to default. Moreover, changes in consumer behavior and preferences towards ownership or alternative transportation methods can also contribute to varying loan default rates within the auto industry.

Loan Terms and Conditions Analysis

The terms and conditions of car title loans play a significant role in shaping the default statistics within the auto industry. These agreements often come with stringent requirements that can impact borrowers’ ability to repay, leading to higher default rates. Lenders typically offer quick approval processes, enticing potential clients with immediate access to cash advances. However, the ease of obtaining these loans might contribute to irresponsible borrowing decisions, where individuals take on more debt than they can manage.

A close analysis reveals that loan terms, including interest rates, repayment periods, and collateral requirements, are critical factors influencing default behavior. Houston title loans, for instance, often have shorter repayment timelines, putting borrowers under pressure to meet deadlines or face penalties. Understanding these dynamics is essential when examining car title loan default statistics, as it provides insights into the financial health of both lenders and borrowers within the auto industry.

Impact of Car Condition on Repayment Behavior

The condition of a borrower’s car plays a significant role in their repayment behavior when it comes to car title loans. In general, vehicles in better working order and with lower mileage tend to be associated with reduced default rates. Borrowers who maintain their cars well are more likely to keep up with loan repayments, as they have a greater incentive to preserve the value of their asset. Conversely, poor vehicle condition can indicate financial strain or a lack of investment in maintenance, which may lead to missed payments and defaults.

This dynamic is particularly relevant when considering that car title loans are secured by the borrower’s vehicle. If the car’s value decreases due to neglect or an accident, the borrower might find it harder to refinance or sell the vehicle in order to repay the loan, increasing the likelihood of defaulting. On the other hand, borrowers who prioritize regular maintenance and repairs can extend the life of their vehicles, offering them more flexibility in managing their loans through flexible payment plans and, if needed, extending the loan term. Thus, promoting responsible car ownership and providing education on vehicle maintenance could contribute to healthier car title loan default statistics.

The auto industry’s influence on car title loan default statistics is multifaceted, with economic factors, loan terms, and car conditions playing significant roles. By understanding these components, lenders can better assess risk and implement strategies to mitigate defaults. Navigating these factors allows for more accurate predictions and informed decisions in the car title loan market, ultimately fostering a more stable financial landscape for both lenders and borrowers.